To learn more about relationship-based ads, online behavioral advertising and our privacy practices, please review the Bank of America Online Privacy Notice and our Online Privacy FAQs. These ads are based on your specific account relationships with us. By allocating an agreed upon sum of money to an individual to spend on their support needs, personal budgets represent the ultimate expression of public. In addition, financial advisors/Client Managers may continue to use information collected online to provide product and service information in accordance with account agreements.Īlso, if you opt out of online behavioral advertising, you may still see ads when you sign in to your account, for example through Online Banking or MyMerrill. If you opt out, though, you may still receive generic advertising. If you prefer that we do not use this information, you may opt out of online behavioral advertising.

PERSONAL BUDGET OFFLINE

This information may be used to deliver advertising on our Sites and offline (for example, by phone, email and direct mail) that's customized to meet specific interests you may have. Here's how it works: We gather information about your online activities, such as the searches you conduct on our Sites and the pages you visit. Relationship-based ads and online behavioral advertising help us do that. And if you still have questions about your insurance and your budget, talk to TruStage® today.We strive to provide you with information about products and services you might find interesting and useful. Try using our budget calculator and other budget-focused resources. If youve had a care and support assessment from us, well.

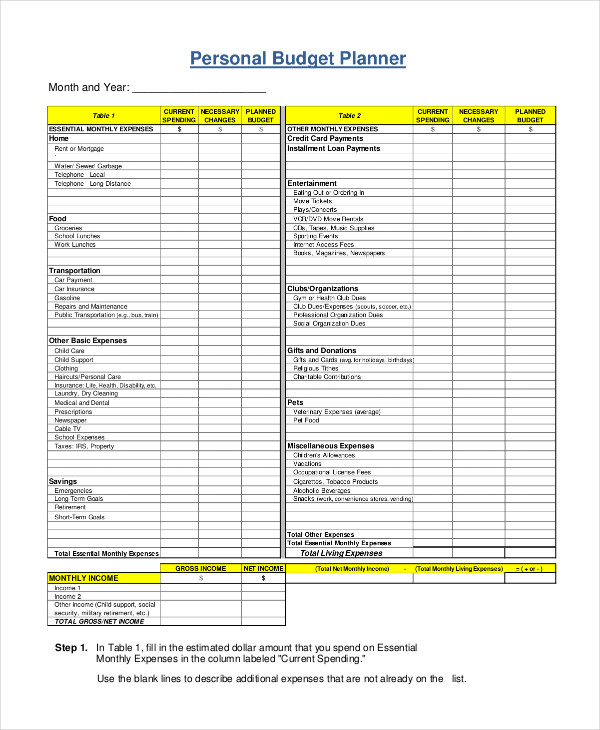

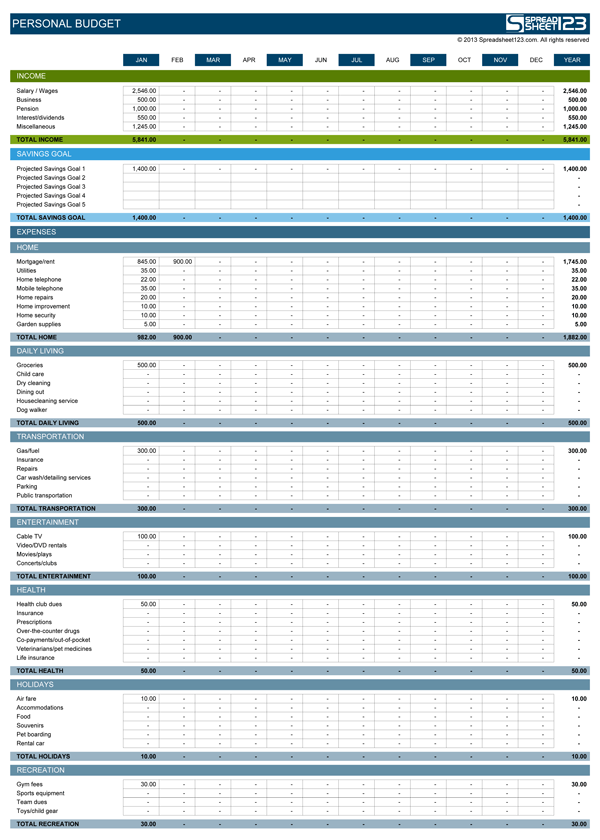

PERSONAL BUDGET HOW TO

Need help setting up your budget? No worries. What a personal budget is, when you receive one and how to use it towards your care and support plan. Whether you use an online spreadsheet, a journal or a personal finance app like Mint, make sure to track your budgeting and spending. The important point is that you just try to achieve a healthy balance. You can tinker with those levels and find a budget that works for you. They're more like a guide toward effective budgeting. The 50/30/20 structure is often best used as a starting point.

You know how much income you're working with and where you need to cut back on spending. And you’ll be able to see whether it makes sense to reduce spending or stash more money in savings.īy this point, you might have a better idea of your personal finances. You can see exactly where your money is going. One of two things will happen: Either you'll have some money left over, or you'll end up in the red by spending more than you make. Once you have your two numbers - money in and money out - subtract your costs from your income. This might include money spent on dining out, clothes, entertainment or subscriptions for Netflix or Spotify. Then, add any expenses that may change each month.

Debt payments, like on a credit card account or student loan.

If you work more than one job, add your net pay together. If you work a payroll job, that's after-tax pay you bring home. Your income is the starting point. Begin by figuring out your total income. If you need a budget, here's a simple guide on how to create one.Ī budget is more or less a measure of money in vs. They're also a way to help plan for the future and set goals, like saving for retirement or a big purchase. Personal budgets are more than a way to track spending. But the other truth about budgets? They work. Anybody who has a family budget knows how difficult it is to keep up with month after month.

0 kommentar(er)

0 kommentar(er)